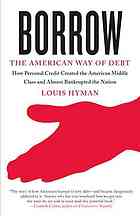

Borrow

The American Way of Debt

- اطلاعات

- نقد و بررسی

- دیدگاه کاربران

نقد و بررسی

October 24, 2011

Credit is both a ticket to good times and an economic cancer in this savvy history of consumer debt. Economic historian Hyman takes readers from the 19th century, when household borrowing was considered immoral and illegal, to our current reliance on ubiquitous consumer borrowing as economic engine and marker of middle-class respectability. It’s a story of unsung but crucial innovations in the plumbing of the economy: mass mortgage lending and securitization, which caused as much mischief in the Great Depression as in today’s subprime crisis; auto-loan operations that turned carmakers into giant banks; the fraud-ridden construction of the Visa and Mastercard credit card networks. Intelligently analyzing both the economics and the social meaning of debt, Hyman grounds these developments in commercial imperatives and an evolving consumer culture, and links them to deeper economic upheavals. Credit fueled growth, he argues, but it also generated instability and asset bubbles, and corroded America’s productive capacities: as consumer lending became more profitable than actually making things, corporations poured their money into financing credit and killed off their manufacturing operations. Stocked with colorful personalities and trenchant insights, Hyman’s lucid, entertaining, and timely treatise illuminates the murky processes by which debt became the troubled center of economic life. Photos.

November 15, 2011

From an economic historian, a timely look at the evolution of consumer debt in the United States. Staggering debt, specifically in the form of student loans, accounts for many of the numbers swelling today's Occupy Wall Street movement. Having graduated into a market where there are no jobs, young Americans feel bitterly duped at having pointlessly incurred the sort of "good" debt traditionally assumed by previous generations, confident that dividends would be forthcoming. How did we reach this pass? Hyman (Industrial and Labor Relations/Cornell Univ.; Debtor Nation: The History of America in Red Ink, 2011) takes us almost decade by decade through the history of consumer debt, beginning just prior to the 1920s when individual borrowing still carried a moral stigma. The advent of the automobile changed all that. Soon, buying cars and houses on credit--all OK according to sophisticated financial advisors as long as the purchases conformed to a "budget" easily calculated when incomes were rising and jobs rarely lost--became a mark, not of being unable to pay, but rather of trustworthiness and stalwart character. Properly understood, borrowing is neither good nor bad in itself. Rather, it's a part of American capitalism, "more than numbers, it is a set of relationships between people and institutions" well within our power to regulate. From the time when lenders and borrowers stared at each other across a desk to today's impersonal transactions where debt can be traded "like any other commodity," Hyman fills his narrative with a variety of tales that help us put the current economic turmoil in perspective. Confirmed free-marketeers will balk at portions of his analysis, thinking he's gone too easy, for example, on Fannie Mae and Freddie Mac, and hold his big-picture solutions--new federal agencies to evaluate businesses the same way the FHA created standards for homes and to coordinate the secondary market for securitization of business loans--at arm's length, even if they agree with his goal of stimulating business investment. For the most part, however, this is an evenhanded account aimed at the general reader baffled by today's economic crisis. From Model-Ts to TVs to McMansions, Hyman uncovers the credit story behind all the glittering prizes and offers a prescription to prevent the American Dream from turning into the American Nightmare.

(COPYRIGHT (2011) KIRKUS REVIEWS/NIELSEN BUSINESS MEDIA, INC. ALL RIGHTS RESERVED.)

January 1, 2012

Debt is an integral part of life in the United States; Americans borrow money to purchase products, houses, and college educations--to the point that the average American owes more than $15,000 in credit card debt alone. How did debt become so pervasive? In this clearly written, carefully researched book, Hyman (labor relations, law, & history, Cornell Univ.) explains the growth of personal loans, from the early 20th century to today. He walks readers through the car's transformation from luxury item to commonplace object as a result of manufacturer and dealer financing; the creation of mortgage-backed real-estate bonds, similar to contemporary securities, that contributed to the Great Depression; and retailers' changing sales tactics to increase impulse purchases while promoting in-store credit. Readers will come to understand that credit difficulties are not new. A final chapter offers solutions to this seemingly intractable problem. VERDICT Hyman published a similar book, Debtor Nation, last year through Princeton University Press, but it is denser and better suited to scholarly readers. This book is recommended for undergraduates and the general public.--Heidi Senior, Univ. of Portland Lib., OR

Copyright 2012 Library Journal, LLC Used with permission.

January 1, 2012

We learn from historian Hyman that when debt became a commodity to be bought and sold, it enabled the growth of the twentieth-century economy. Americans increasingly relied on expected future income from wages rather than cash to make consumer purchases. The author traces consumer debt beginning in the 1910s and through the 1920s, when personal loans became legal and mortgages were in demand. After WWII, consumption continued to be financed by debt, particularly television sets. Returning veterans could borrow easily through the VA loan program, and retailers developed revolving-credit programs. As the century progressed, we learn about the rise of discount stores over department stores, loans financed by issuing corporate debt, securitization, and credit cards. Hyman indicates that although policymakers declare the worst of our current financial crisis ended in mid-2009, important causes continue, and he concludes, Debt, along with every other aspect of capitalism, is something that we have created and have the capacity to master. This is an excellent book.(Reprinted with permission of Booklist, copyright 2012, American Library Association.)

دیدگاه کاربران