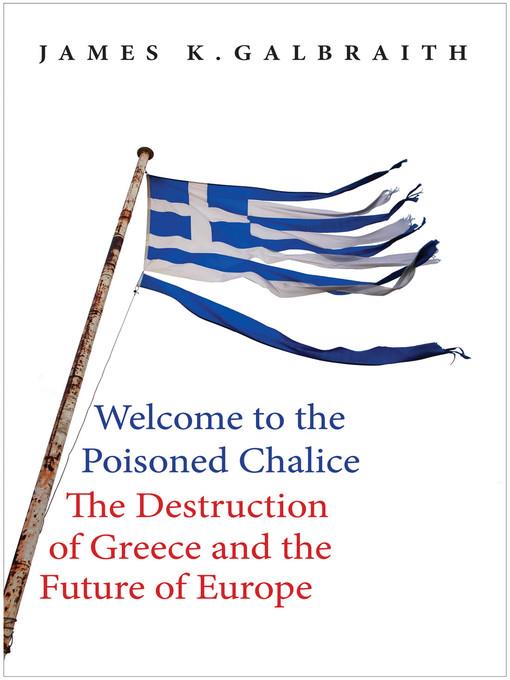

Welcome to the Poisoned Chalice

The Destruction of Greece and the Future of Europe

کتاب های مرتبط

- اطلاعات

- نقد و بررسی

- دیدگاه کاربران

نقد و بررسی

April 18, 2016

This insider’s account gives a step-by-step narration of Greece in crisis from 2010 through October 2015 as the country rebelled against, then finally capitulated to, European Union dictates to repay the national debt. Galbraith, a University of Texas economist, served as advisor to Greece’s finance minister, Yanis Varoufakis, during the crisis. He even helped draft the secret “Plan X” in case Greece needed to exit the Euro. Galbraith argues that the EU’s austerity measures will not only cripple Greece economically—ensuring eventual default or defection from the Euro—but destabilize European unity and encourage right-wing extremism. Galbraith unveils what the European Central Bank’s euphemistic terms really mean for Greece: an increase in the value-added tax rate to 23% (driving tourism, Greece’s largest industry, elsewhere), depressed wages and pensions, loan defaults, and liquidity crises. Moreover, this economic death spiral could spread to other EU countries. Whatever the outcome, this is an eloquent and informed chronicle of the Greek debt crisis for current readers and future historians. Agent: Wendy Strothman, Strothman Agency.

May 1, 2016

A series of essays, letters, and other documents examining the latest Greek tragedy.Is it possible to save the eurozone? Given the events that have settled on Greece, suggests acclaimed economist Galbraith (Chair, Government/Business Relations/Univ. of Texas; Inequality: What Everyone Needs to Know, 2016, etc.), the odds weigh against it; it seems likelier "that the euro will, at some point, in some country, crack." In one view, the drama of Greece, beset by creditors and pushed into unwonted and unwanted austerity, is merely a "side effect of the global banking and financial disaster" that began to steamroll its way across the world in 2007--a disaster that had its origins in sloppy American fiscal practices and that took down many other economies with it. In another view, it is a continuation of indifferent, occasionally hostile relations between Greece and other European nations, which treat it as an unwelcome guest at the banquet. Galbraith writes sometimes as a journalist, sometimes as a policy analyst, sometimes as an outright advocate for Yanis Varoufakis, the Greek economist and liberal politician who has been leading a resistance movement against European Union-imposed austerity programs that disregard certain Greek realities--e.g., the facts that it has an aging population with a poor system of unemployment insurance as well as "one of Europe's most militant working classes," not likely to be compliant with the directives of German banks and Belgian bureaucrats. The breakup of the eurozone, writes the author, might not be an altogether bad thing. And in the place of the euro? It's anyone's guess, but Galbraith reminds us that after the gold standard collapsed, Bretton Woods came along, and the world did not end. A book best read by policy wonks of a numerate bent but accessible to noneconomists as well.

COPYRIGHT(2016) Kirkus Reviews, ALL RIGHTS RESERVED.

دیدگاه کاربران