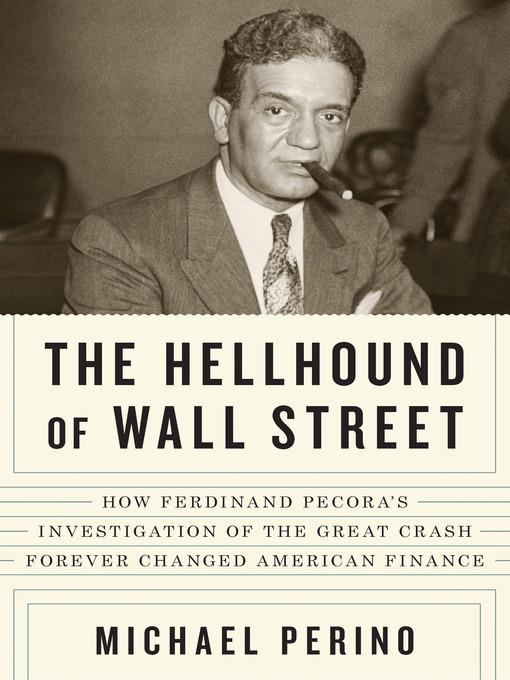

The Hellhound of Wall Street

How Ferdinand Pecora's Investigation of the Great Crash Forever Changed American Finance

کتاب های مرتبط

- اطلاعات

- نقد و بررسی

- دیدگاه کاربران

نقد و بررسی

July 19, 2010

Perino, law professor at St. John's University, recounts the 1933 investigation into Wall Street abuses by the Senate Committee on Banking and Currency, focusing on the 10-day interrogation by chief counsel Ferdinand Pecora of executives of National City Bank (precursor to Citigroup). A morass of tawdry scams surfaced in the hearings: the bank's in-house stock pools artificially inflated its own stock; bank officers gave themselves no-interest (and apparently no-repayment) loans; mom-and-pop investors relying on National City's supposedly impartial advice were sold dubious securities in which the bank had a hidden financial interest. The author argues that Pecora's revelations, coming amid the 1933 bank collapse, stoked public outrage and paved the way for unprecedented government regulation of the financial system. Perino's narrative is a lucid account of period banking and stock-market swindles and a crackerjack legal drama, as Pecora's cunning, relentless questioning demolished the bankers' evasions. (The Sicilian immigrant's triumph over the WASP financial elite also heralded a social revolution, the author contends.) Perino's book is a trenchant, entertaining study of the New Deal's heroic beginnings, one with obvious relevance to latter-day efforts to rein in Wall Street's excesses.

June 15, 2010

The story of a little-known New York City lawyer who investigated Wall Street and the big banks during the Great Depression, resulting in major reform legislation.

Ferdinand Pecora (1882–1971) went to Washington, D.C., at the end of the Herbert Hoover presidency, just before the inauguration of Franklin D. Roosevelt. Although a Democrat politically, the Sicilian-born lawyer answered a plea from a Republican senator who chaired the banking committee and believed that Wall Street fat cats, many of them Republicans, had played nefarious roles in the stock-market crash of 1929. Because of Senate rules, Pecora had only a few weeks to learn the complex inner workings of big savings and investment banks. A quick study with experience as a prosecuting attorney in New York, he turned out to be remarkably effective as a questioner of multimillionaire bank and Wall Street investment-house executives. In normal circumstances, senators themselves questioned the witnesses at investigative hearings. But they found Pecora so effective that they gave him center stage while they acted as a background chorus. Perino (Law/St. John's University) explains that senators, witnesses and journalists alike tended to underestimate Pecora because of negative stereotypes about southern Italians, because of his short stature and because of his inexperience in the Wall Street realm. The narrative is built around the ten days of Senate hearings starring Pecora, with each day receiving extended treatment based on surviving transcripts and other public records. Although Perino admires Pecora, the author avoids hagiography by mentioning his subject's occasional vanity; obsequiousness to, among others, Roosevelt; extramarital affairs; and other negative traits. Although he lived into the '70s, Pecora was mostly forgotten after the ten days of hearings, serving well but outside the limelight as a judge. If the legislative and regulatory reforms had been more enthusiastically enforced during the past three decades, the current financial meltdown might have been alleviated.

A thorough, well-written history that shows how the past can be prologue.

(COPYRIGHT (2010) KIRKUS REVIEWS/NIELSEN BUSINESS MEDIA, INC. ALL RIGHTS RESERVED.)

Starred review from September 15, 2010

Amid the Great Depression, a largely forgotten hearing led to the ten days that would fundamentally change Wall Street. This look at the 1933 Senate hearings to determine the cause of the financial crisis of the 1920s and 1930s is divided into two parts. First, Perino (Dean George W. Matheson Professor of Law, St. John's Univ. Sch. of Law) sets the stage for this drama, examining the situation and the players, particularly the background of Ferdinand Pecora, the lead counsel for the hearing, and his main adversary, Charles Mitchell, chairman of National City Bank. In the second half, Perino details the testimony from each over the ten days, adds his interpretation of the importance of what Pecora revealed about Wall Street practices, and links these revelations to their place in history. VERDICT Perino's narrative style and reliance on primary sources make this a great selection for fans of history and economics and for those wanting more background on the tenuous relationship between Washington and Wall Street.--Elizabeth Nelson, UOP Lib., Des Plaines, IL

Copyright 2010 Library Journal, LLC Used with permission.

September 1, 2010

Academic and securities authority Perino recounts in detail the dramatic story of the Senate hearings on the causes of the 1929 stock market crash. These hearings concluded shortly before President Franklin D. Roosevelts famous inaugural address on March 4, 1933, in which he noted that the only thing Americans had to fear was fear itself. This is the tale of 10 critical days of those Senate hearings led by Ferdinand Pecora, an Italian immigrant lawyer, New York Citys former assistant district attorney and chief counsel for the Senate Committee on Banking and Currency. Prior to 1933, the federal government did not concern itself with Wall Street. Pecoras hearings represented the first time in U.S. history that Wall Street was subjected to a public accounting, and Pecoras skill in taking the spirit of the early Depression and drawing from it hard facts and concrete evidence changed forever the relationship between Wall Street and Washington. This excellent book is timely in light of the 2008 turmoil in financial markets.(Reprinted with permission of Booklist, copyright 2010, American Library Association.)

دیدگاه کاربران