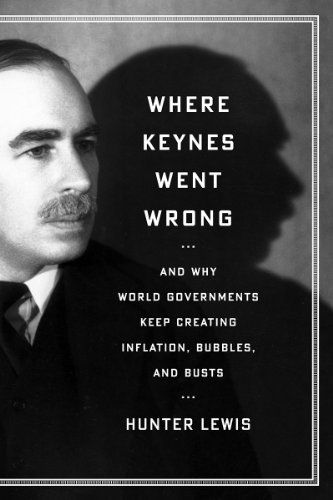

Where Keynes Went Wrong: And Why World Governments Keep Creating Inflation, Bubbles, and Busts

english

In responding to the financial crash of 2008, both the Bush Administration and the Obama Administration have relied on prescriptions developed by John Maynard Keynes, the most important economist since Marx. But should we be relying on Keynes? What did Keynes actually say? Did he make his case? Hunter Lewis concludes that he did not. If Keynes was wrong then so are the economic policies of virtually all world governments today.

لغو

ذخیره و ثبت ترجمه

دیدگاه کاربران